QQQ

The State of Technology Shares; uptrend, but possibly weakening?

- Things threatening the uptrend

- Technical Structure

- Possible mean reversion target

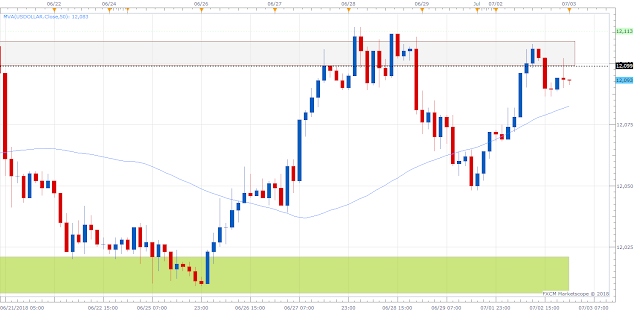

The Candlestick Formational top is in place

- Confirming the leg down has begun, unless stopped

- 50 daily moving average (simple) is only at 171.50

- Retest important base at 169-170

We believe that a return to $170 would be a target that is well within the bounds of most mean reversion trading systems.

A bearish reversal pattern would normally need more time and momentum to prove that it works. This one has some of the same characteristics as the prior crests from February, March, and then June.

6-7 day basing pattern still occured whether it was this past cyle (buy the dip from last week) or the countless other times over the past 2 years when a base would form, and it would take from 5-7 trading sessions before breaking out to newer highs and resume trend.

Path of least resistance is down, yet the trend of "series of higher highs" is an important consideration.