The Big Picture of the US-Dollar Index

Enlarge these charts to see the full image

The Monthly Consideration - 602 points of gains

- Nearly 6 months in a row, the dollar rallied and its starting to take the shape of a late-stage blow-off with waning momentum

- There has not been a negative close or consolidation yet

- The trend overall remains bullish, and the pullback most are anticipating is probably to consolidate its prior gains from Dec of last year until now

The weekly perspective with relative peaks at 12,110

Some of the topping tails are taking hold even if they are above the October highs of last year, there is still a big inflection point at 12,110 and above

Most of the technical barriers to the upside were shattered, but it has since had some trouble closing above 12,113

Trouble on the Daily Chart

Sellers are taking more forceful action, and the patterns of more engulfing bearish candles are beginning to show up

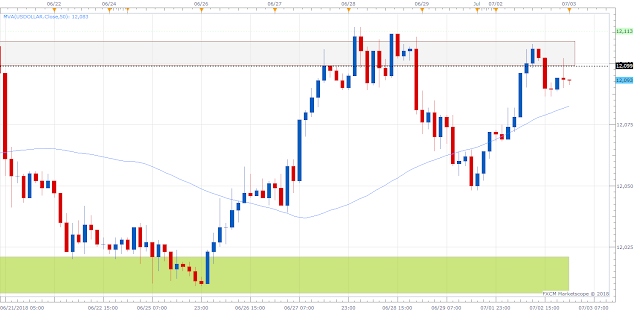

Tactics on the 2 Hour

- The anti-dollar trade is setting up some clean boundaries for day trading tactics

- The high above 12,100 (area) and below 12,025 support. We would be shorting at 12,100 and going long at 12,025 but there will be contingencies

- Price is approaching its 50-period moving average and getting ready to touch it and go below

No comments:

Post a Comment